Question

What duties are taxes on intra-State supplies?

Solution

For taxes on supplies within the same state (intra-State supplies), both the Central Government and the State Government levy taxes. This is known as Central Goods and Services Tax (CGST) and State Goods and Services Tax (SGST) respectively.

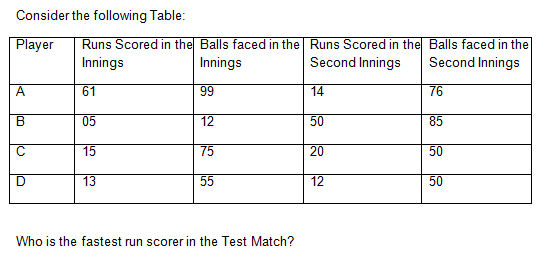

Consider two Statement and a Question :

Statement - 1: Priya is 4 ranks below Seema and is 31st from the bottom.

Statement - 2: En...

A man completes 7/8 of a job in 21 days. How many more days will it take him to finish the job if quantum of work is further increased by 50%?

X and Y run a 3 km race along a circular course of length 300 m. Their speeds are in the ratio 3:2. If they start together in the same direction, how m...

The increase in the price of a certain item was 25%. Then the price was decreased by 20% and then again increased by 10%. What is the resultant increas...

Consider the following multiplication problem:

(PQ) × 3 = RQQ, where P, Q and R are different digits and R # 0.

What is the value of...

In the English alphabet, the first 4 letters are written in opposite order; and the next 4 letters are written in opposite order and so on; and at th...

What is the value of X in the sequence 20, 10, 10, 15, 30, 75, X?

Consider the following statements :

1. The sum of 5 consecutive integers can be 100.

2. The product of three consecutive ...

A person X wants to distribute some pens among six children A, B, C, D, E and F. Suppose A gets twice the number of pens received by B, three times tha...

Relevant for Exams: