Question

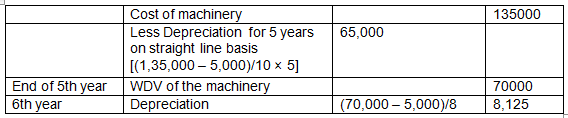

Cost of machine Rs.1,35,000. Residual value Rs. 5,000.

Useful life is 10 years. The company charged depreciation for the first 5 years on straight line method. Later on, it reviewed the useful life and decided to take it as useful for another 8 years. Depreciation amount for 6th year will be:Solution

Date Particulars Amount Amount  Note: In case of revaluation, the depreciation is calculated on the total revalued amount over a period of balance useful lives assessed on the date of revaluation. New cost for the purpose of depreciation will be gross cost less accumulated depreciation on the date of revaluation.

Note: In case of revaluation, the depreciation is calculated on the total revalued amount over a period of balance useful lives assessed on the date of revaluation. New cost for the purpose of depreciation will be gross cost less accumulated depreciation on the date of revaluation.

Choose the odd one from the following.

The HCF of two numbers is 7 and their LCM is 434. If one of the numbers is 14, find the other.

The sounds having a frequency of 20 Hertz to 20,000 Hertz are known as –

Which of the following best defines social security?

In the year 1919, what was the reason for Mahatma Gandhi to warn the Viceroy that a countrywide Satyagraha would be launched?

In the FIFA rankings of 2023, at what position does India rank?

Which one of the following is the first book in which the transactions of a business unit are recorded ?

Who among the following has claimed number one ranking in men’s javelin for the first time in May 2023?

A cost incurred in the past and that cannot be recovered in the future is called ________.

Soil degradation is one of the major environmental problems being faced these days. A wide range of techniques to conserve soil are mentioned below. Sel...